Weekly Macro Update: What’s Next After Friday’s Flash Crash?

13 October 2025·3minFriday’s sharp sell-off invalidated many of the short-term technical patterns traders had been relying on. With several indicators showing sustained selling pressure, a quick recovery looks unlikely in the near term.

2. Stocks Followed the Downtrend

The broader stock market wasn’t spared either. While the SPX is showing signs of technical strength and a gradual rebound, overall sentiment remains negative. Investors continue to prioritize caution over risk-taking.

3. Options Open Interest Hits Historic Lows

The liquidation of leveraged positions also caused a steep drop in open interest for options. Volumes have fallen to historically low levels, prompting us to consider alternative indicators until market activity stabilizes.

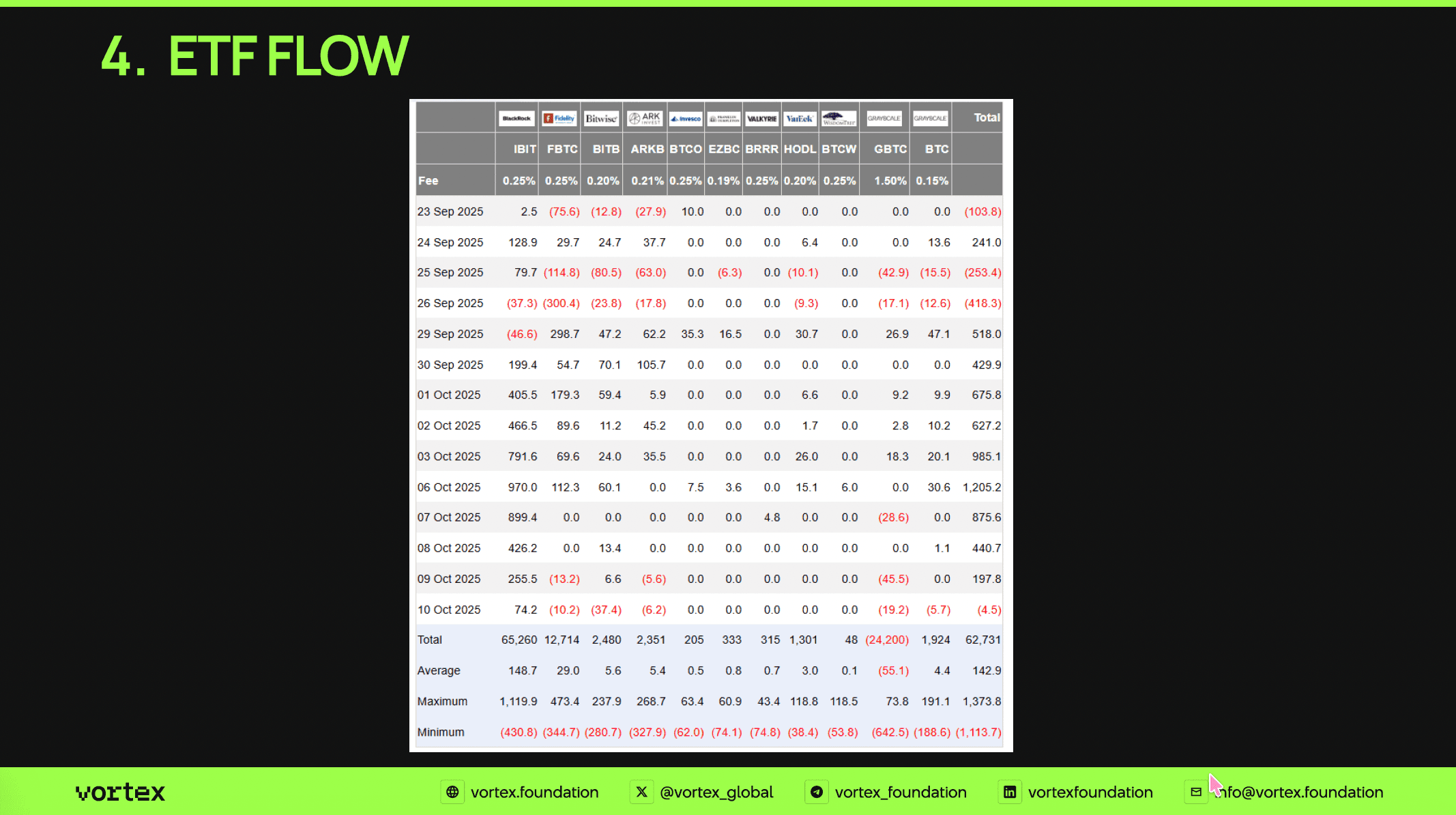

4. ETF Inflows Stalled

Early last week, ETF inflows were notably strong, but by Friday, they had nearly vanished. Because the crash occurred after the main trading session, this week’s data will be key to understanding whether institutional appetite is returning or pausing.

5. Major Liquidations Could Clear the Path

The scale of recent liquidations was enormous. However, this process may have helped the market reset. With many overleveraged positions flushed out, conditions are forming for a potential new trend, once a balance between buyers and sellers emerges.

6. Short-Term Volatility Persists

Liquidation volume remains slightly elevated, hovering around the 112–113K range. Many traders appear to be positioning for a quick rebound, but this dynamic could easily lead to another leg down, potentially toward the 100K zone.

7. BTC Still Looks Attractive on Fundamentals

Despite the turbulence, Bitcoin’s fundamentals remain strong. From a traditional P/E ratio perspective, it continues to stand out as an attractive long-term asset. The recent correction has done little to change the broader investment picture.