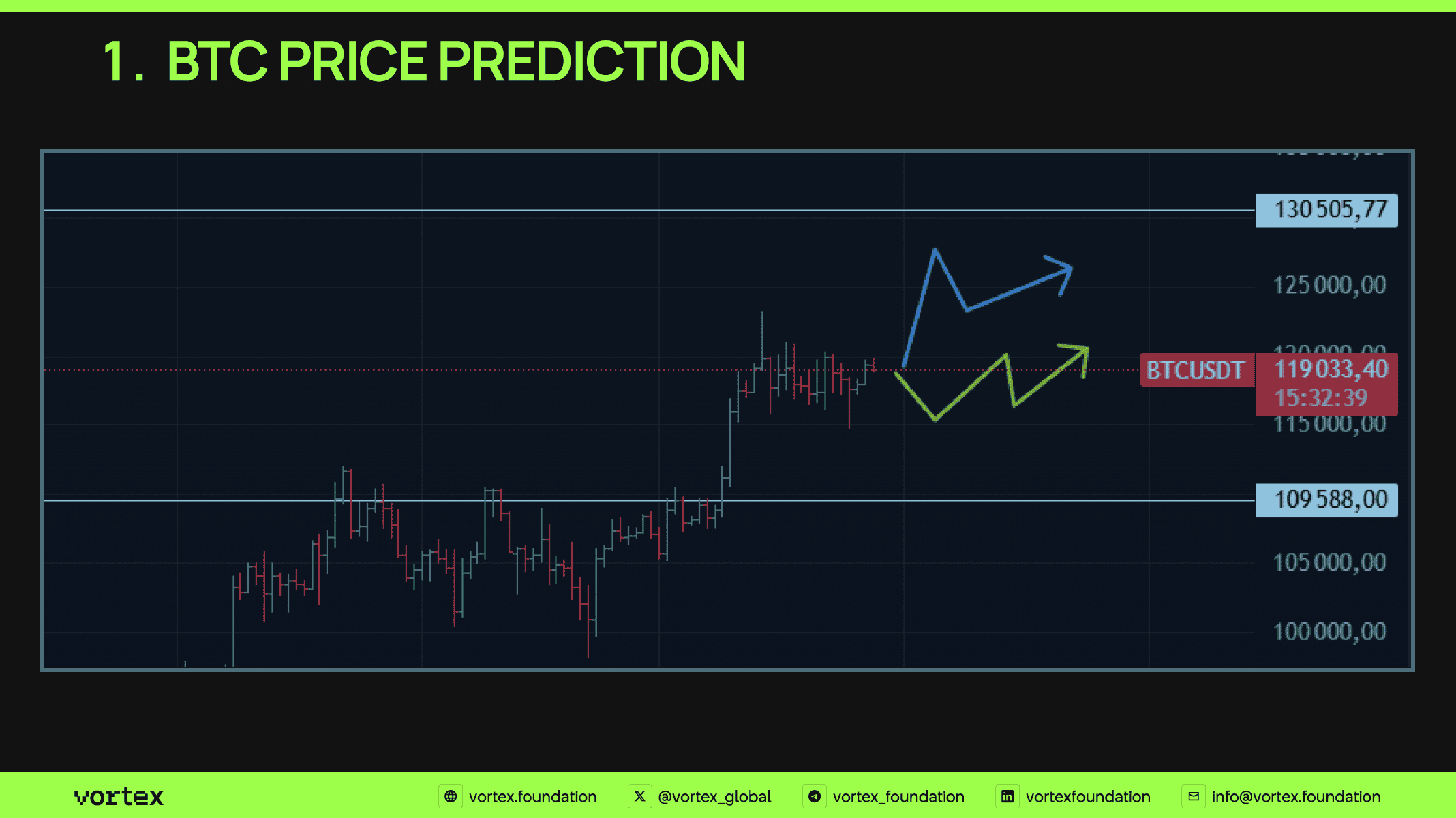

Decoding Bitcoin's Current Landscape: A Mid-Year Market Snapshot

28 July 2025·2min

Our technical setup for Bitcoin, and our overarching market perspective, remains consistent. While a new wave of global trade tensions has the potential to introduce volatility into the market, we're currently seeing no significant risk priced in by market participants. This suggests a wait-and-see approach, with the market not yet convinced of a major impact from these geopolitical narratives.

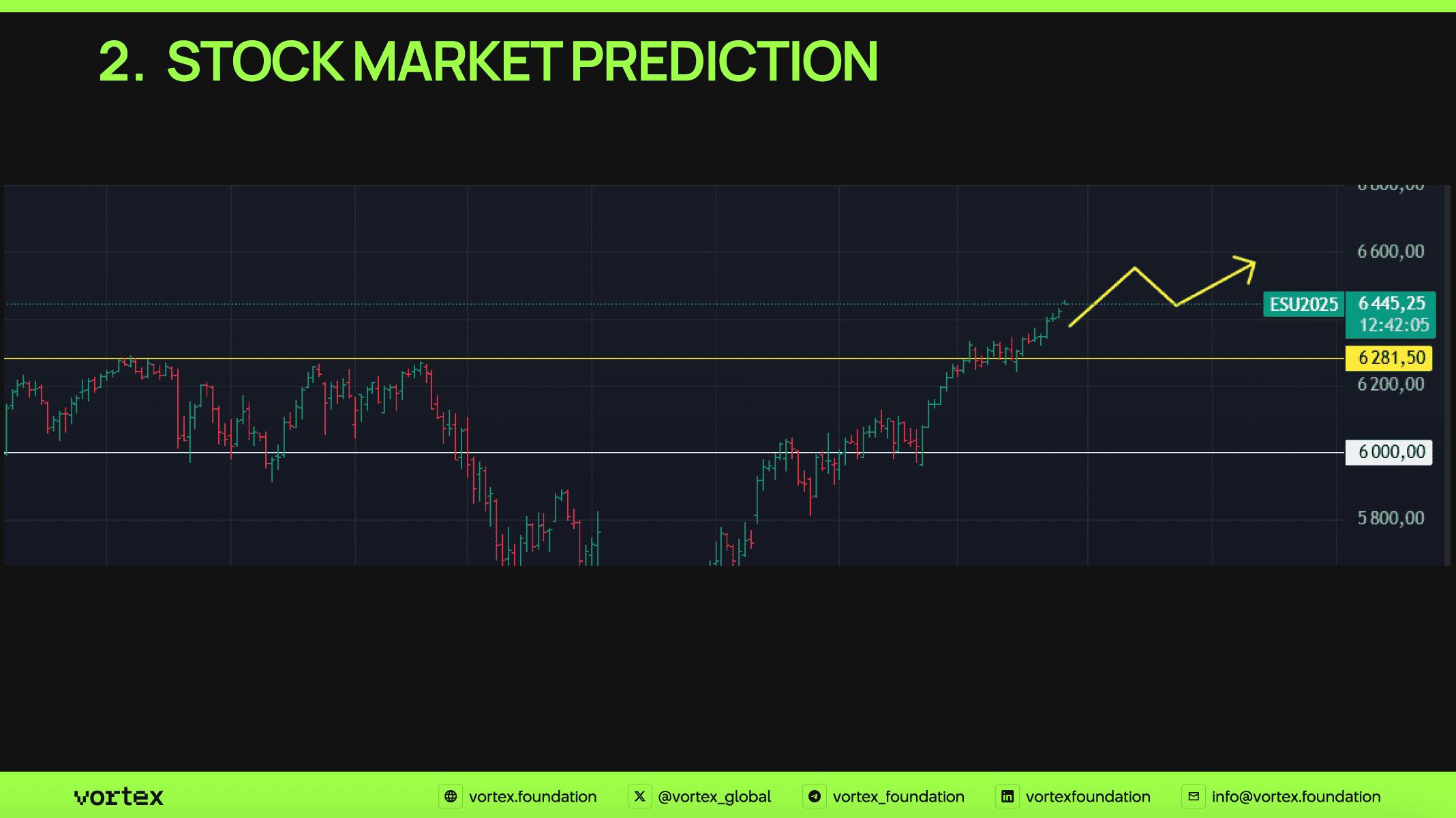

Stock Market's Ascent: A Cautious Climb

The stock market continues its upward trajectory, albeit with a noticeable deceleration in its pace of growth. From a medium-term vantage point, we maintain a cautiously optimistic outlook. Even if the aforementioned geopolitical risks begin to materialize, our underlying positive sentiment for equities remains, albeit with an added layer of prudence.

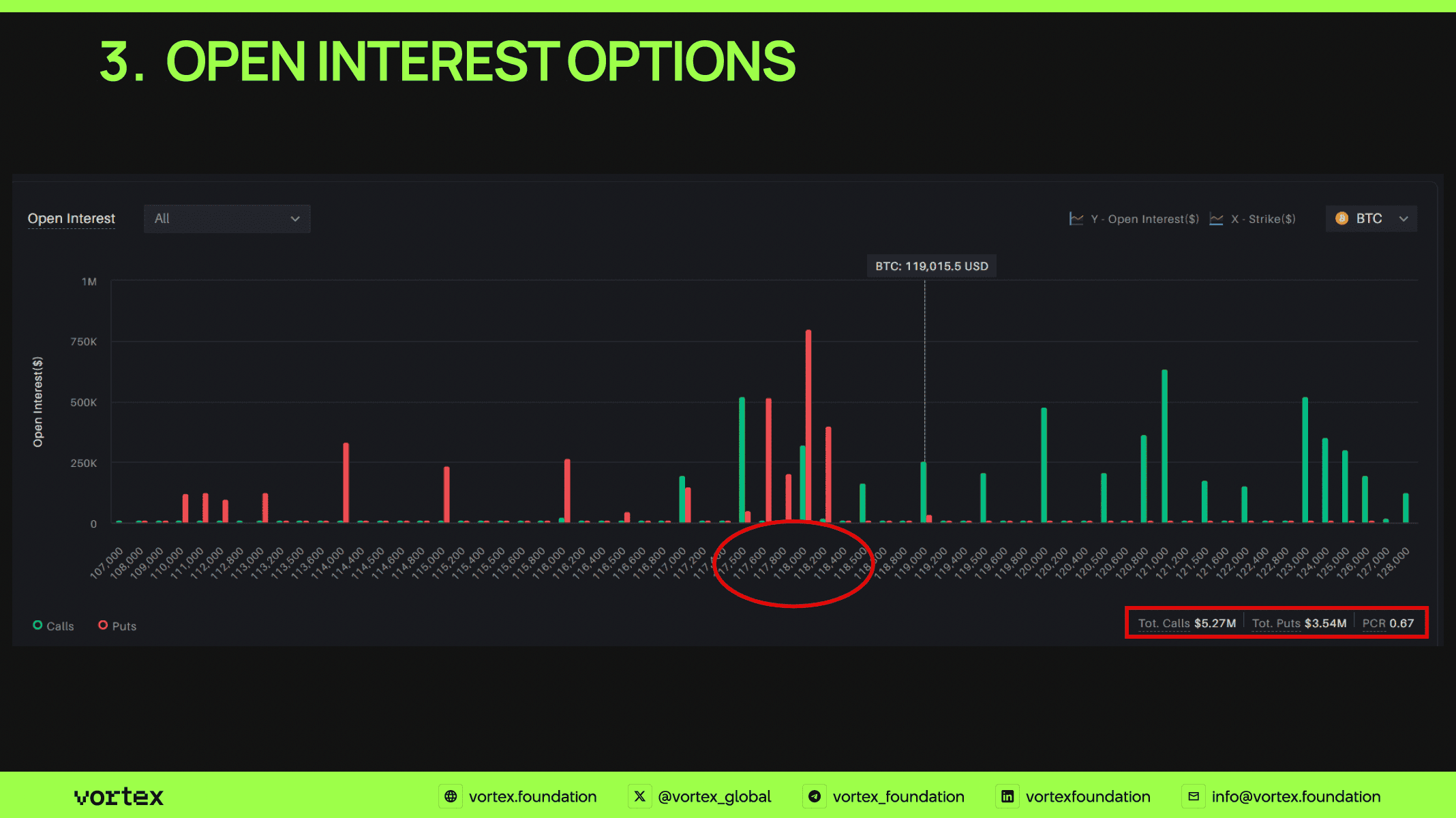

Options Market Shifts: A Glimmer of Short-Term Bullishness?

A significant shift in options positioning has been observed since last week. While overall trading volume remains relatively low, there's been a notable surge in interest for call options. This could be an indicator that market participants are anticipating a sharp short-term rally, potentially fueled by upcoming news. However, it's important to note that this specific data point currently diverges from our broader market view, warranting careful monitoring.

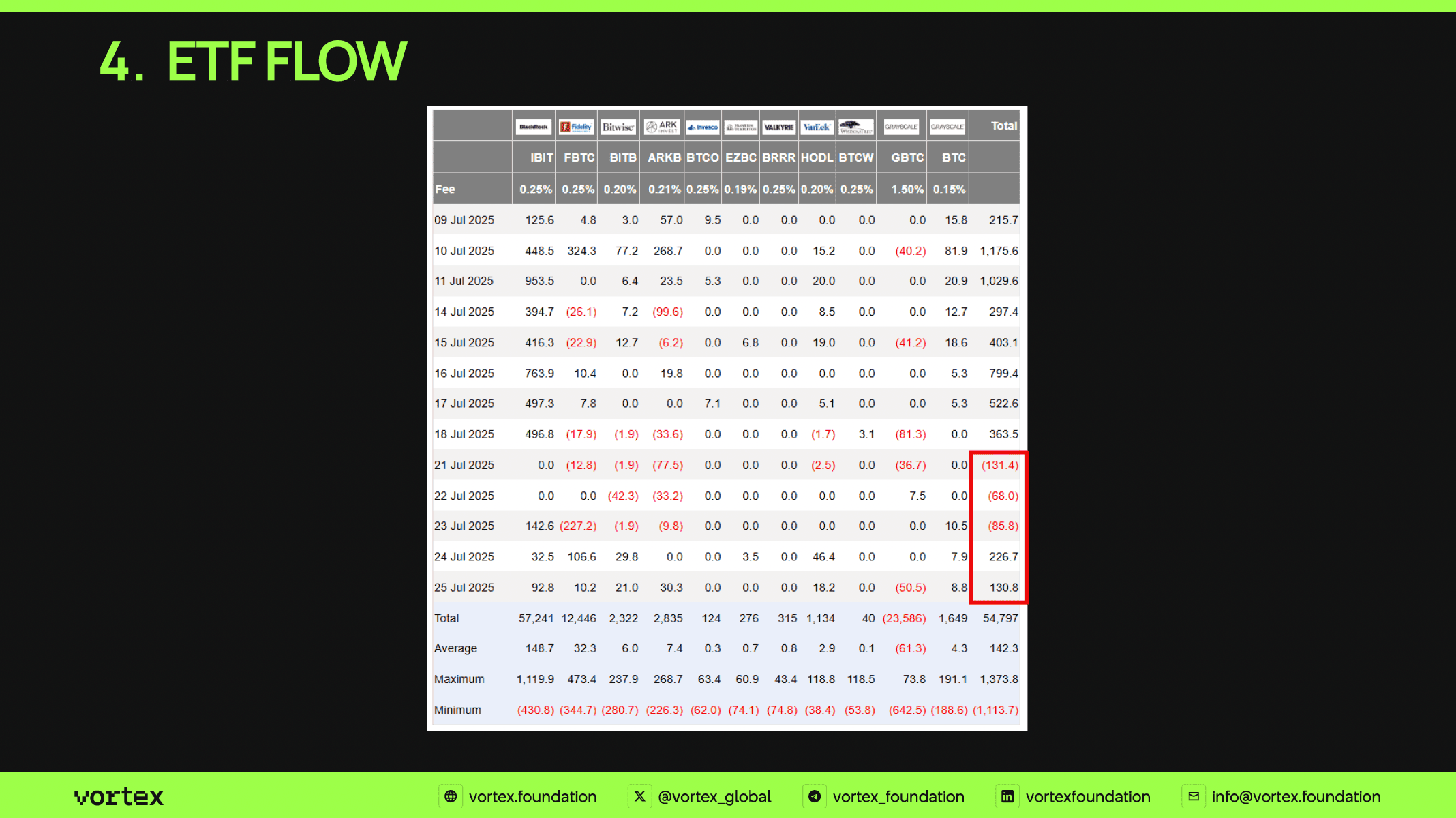

ETF Inflows: A Brief Pause, But Interest Endures

Last week saw a substantial drop-off in ETF inflows, primarily attributed to Bitcoin's sideways price action. Despite this temporary lull, we believe that overall interest in crypto ETFs remains robust. The lack of immediate price momentum hasn't dampened the underlying appeal of these investment vehicles, suggesting that the long-term view for institutional adoption remains positive.

The Awakening of Dormant Coins: A Potential Price Pressure Point?

Since the beginning of the year, we've witnessed a notable increase in the movement of long-dormant Bitcoin coins. In recent weeks, some wallets that have been inactive for as long as 10 years have suddenly become active, with a significant portion of these funds being transferred to exchanges, hedge funds, and other institutional addresses. While it's premature to draw definitive conclusions, this activity could potentially lead to long-term price pressure on Bitcoin, and it's a trend we're closely watching.

Leverage Levels: Fuel for a Short-Term Upside?

Current leverage levels indicate a slight imbalance in the market. The majority of liquidation clusters are presently positioned above the $120,000 mark. This concentration of liquidation points could potentially act as short-term fuel for a local upside move in Bitcoin's price, as a push higher could trigger a cascade of short liquidations.

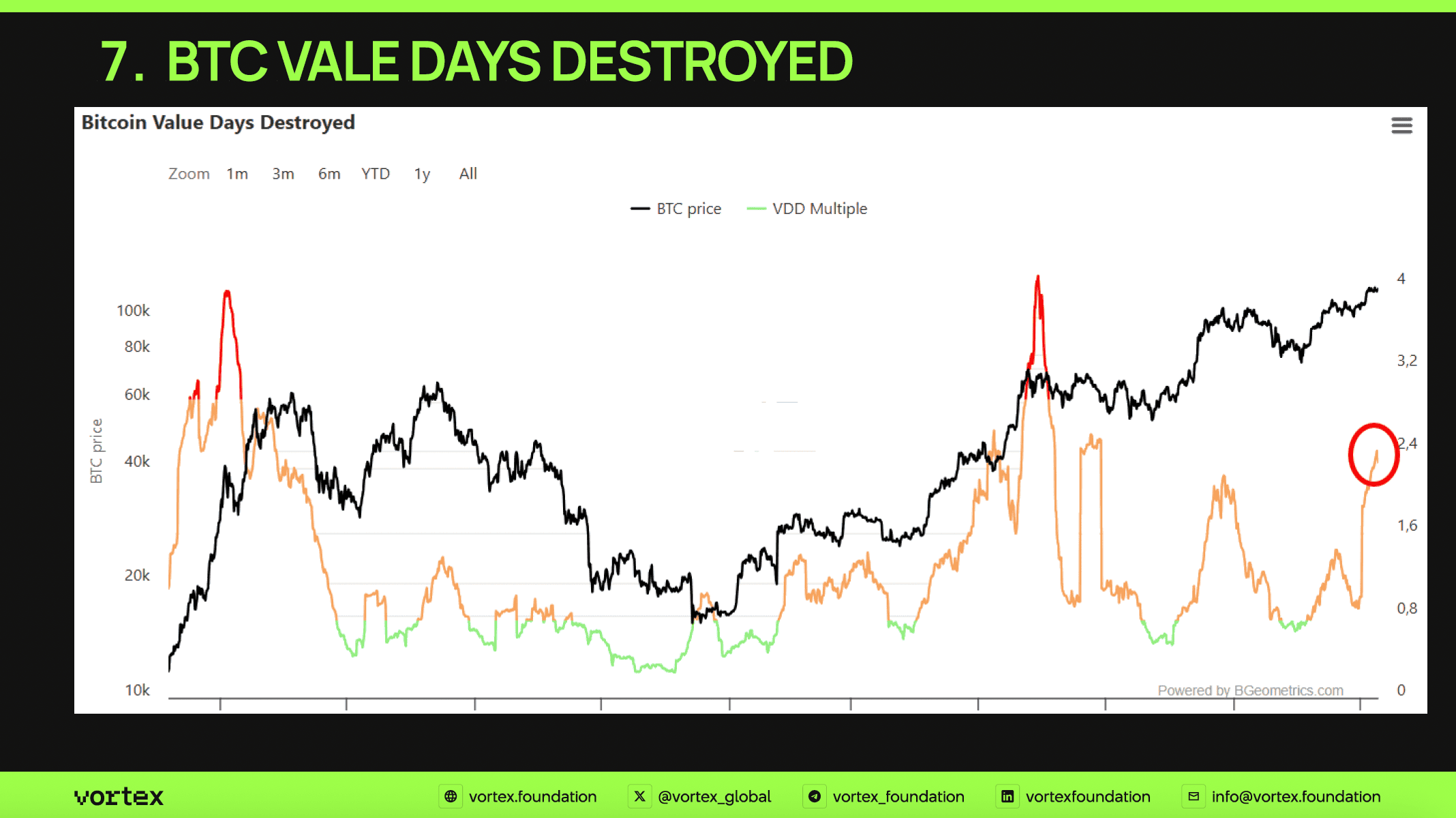

VDD Metric Surges: Is the Trend Overheating?

The VDD metric has seen a significant surge since the start of the month, suggesting that the current market trend may be overheating. If this metric continues to climb in conjunction with shifts in other key indicators, we will begin to reassess our broader market expectations, potentially signaling a need for a more cautious stance.

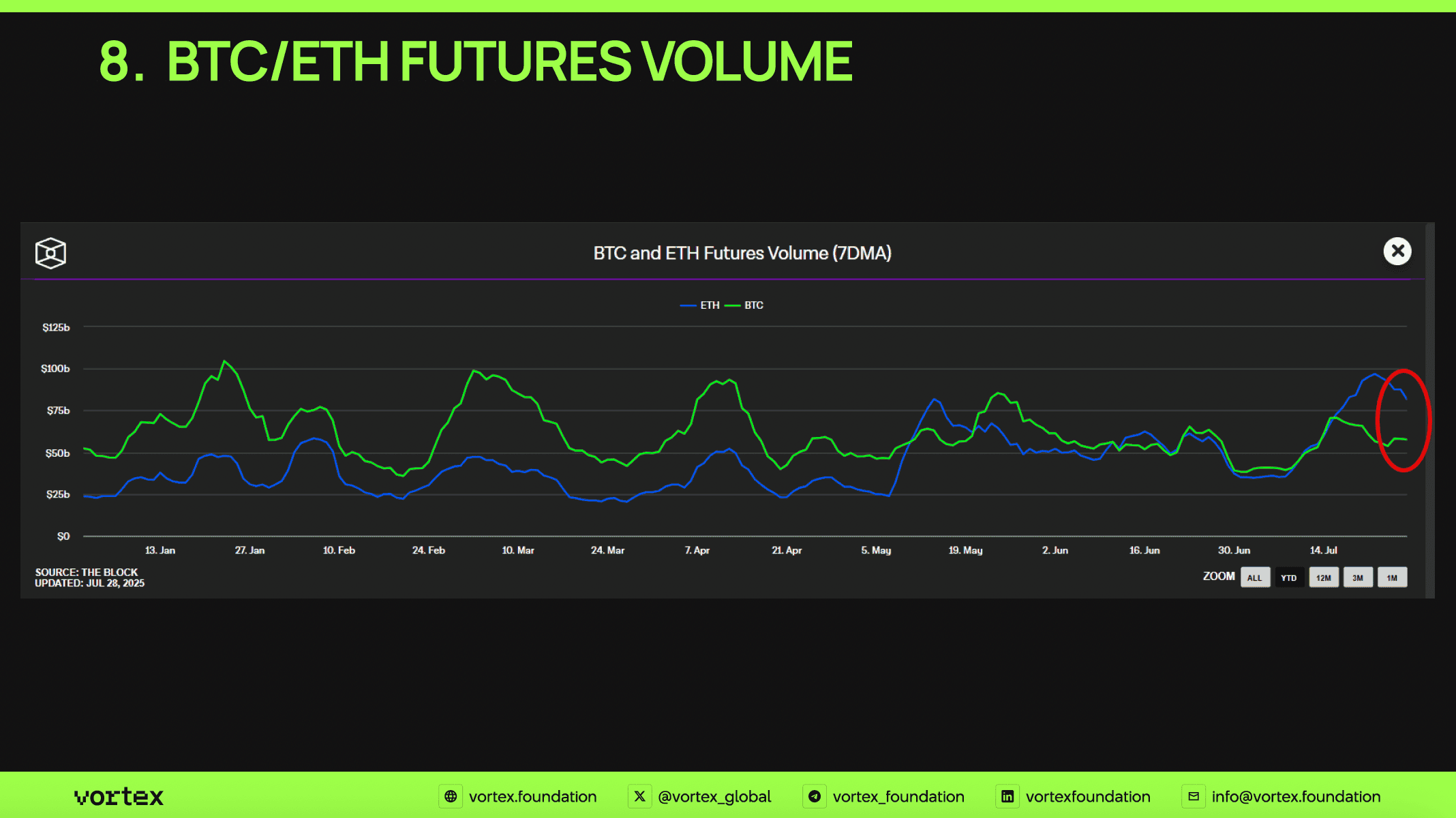

Futures Trading: ETH Steals the Spotlight, Altcoins to Follow?

While Bitcoin futures trading volumes have remained stable, Ethereum (ETH) futures volumes continue to be substantially higher, even when compared to the beginning of the year. This elevated activity in ETH futures suggests that altcoins will likely continue to show elevated activity in the near term, potentially leading to more significant price movements in the broader altcoin market.